Cancelling your registration will remove your access to the event. If you proceed, you will no longer be able to participate or access event-related materials.

Deleting your account will remove your access to the event.

Need Technical Assistance? ✉ tech@vfairs.com

Maria Lehtimäki

Partner | Waselius

Partner | Waselius

Maria is the head of structured finance and securitisation at the independent Finnish law firm Waselius. She advises financial institutions, investors and corporates on securitisation and structured finance transactions across a variety of asset classes and industries, including aviation. She also advises clients on cross-border leveraged financing and capital markets transactions and related regulatory matters and has experience in special situations financing and distressed investments.

Markus Nilssen

Moderator

Partner | BAHR

Partner | BAHR

Henrik Ossborn

Partner | Vinge

Partner | Vinge

Henrik Ossborn is a partner in the banking and finance group at Vinge. He advises on a broad range of finance transactions, with a particular focus on securitisations, supply chain financings, project finance and other asset-based financings. He is a leading practitioner in this field with extensive experience, having worked on these types of transactions for more than 20 years. Henrik has acted for banks, investors and originators across Europe.

Playing with possible evolutionary outcomes for European finance, to help decide what is needed from securitisations.

Like the mass of the Higgs determines the structure of our universe, the precise parameters of securitisation regulation define the financial universe - change them even fractionally, and what can exist and how it interacts is completely different.

Veronika Hillesland

Senior Advisor | Finanstilsynet (FSA Norway)

Senior Advisor | Finanstilsynet (FSA Norway)

Veronika is a Senior Advisor at Finanstilsynet, where she has spent the past year working in the supervision of large banks, with a particular focus on securitisation. Prior to this, she spent over four years at the European Central Bank, contributing to policy and supervisory work related to capital, consolidation, and accounting issues. She also brings private sector experience from her time at Santander Nordics, where she worked for one and a half years in capital management.

Andrew Bryan

Knowledge Director | Clifford Chance

Knowledge Director | Clifford Chance

Idar Fagereng

SVP - Active Portfolio Management | DNB

SVP - Active Portfolio Management | DNB

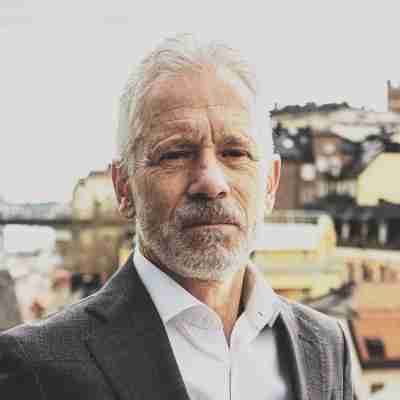

Markus Nilssen

Moderator

Partner | BAHR

Partner | BAHR

Martijn Van Der Molen

Managing Director | CRC

Managing Director | CRC

Erik Welin

Loan Officer | EIB

Loan Officer | EIB

Fredrik Dahlstrøm

Head of Securitisation | Nordea (Stockholm)

Head of Securitisation | Nordea (Stockholm)

Fredrik Dahlstrøm has over twenty years of experience in the financial industry, with a focus on securitisation, real estate and structured finance. Fredrik is currently Director of Securitisation at Nordea, one of the largest banks in Scandinavia.

Dahlstrøm began their career in 1997 at JP Bank, where they worked in securitisation and corporate bonds. In 1999 they moved to E. Öhman J:or Fondkommission, where they advised clients on structured financings involving securitisation, debt and equity.

Dahlstrøm has been with Nordea since 2001, and has held various positions within the bank, including Head of Real Estate and Structured Finance, and Head of Capital Markets. In their current role as Director of Securitisation, they are responsible for originating and structuring securitisation transactions for the bank.

Fredrik Dahlstrøm has a MSc in Economy from The London School of Economics and Political Science (LSE) and a degree in Finance, Economics and Political Science from Lund University.

Morten Holme

Secured Funding Leader | Santander (Norway)

Secured Funding Leader | Santander (Norway)

Henrik Ossborn

Partner | Vinge

Partner | Vinge

Henrik Ossborn is a partner in the banking and finance group at Vinge. He advises on a broad range of finance transactions, with a particular focus on securitisations, supply chain financings, project finance and other asset-based financings. He is a leading practitioner in this field with extensive experience, having worked on these types of transactions for more than 20 years. Henrik has acted for banks, investors and originators across Europe.

Adam Young

Head of Investments | Hoist Finance

Head of Investments | Hoist Finance

Jonas Bäcklund

CEO | Revel Partners

CEO | Revel Partners

Jonas Bäcklund is a seasoned financial services executive with over 25 years of experience in structured finance. Throughout his career, he has held leadership roles across the Nordics, the UK and the US. He was instrumental in establishing Nordea’s successful Significant Risk Transfer programme and has successfully structured, placed, and managed numerous structured credit transactions.

Jonas holds an MSc and PhD from Uppsala University and was a visiting scholar at the Wharton School.

Jonas will be sharing his insights on the evolving Nordic securitisation market, drawing from his extensive experience in structured finance and risk transfer strategies.

Adam Craig

Partner | Clifford Chance

Partner | Clifford Chance

Partner in the Structured, Asset Backed and Real Estate finance (SABRE) team at Clifford Chance LLP, London.

Specialties: Structured Debt and securitisation.

Maria Lehtimäki

Partner | Waselius

Partner | Waselius

Maria is the head of structured finance and securitisation at the independent Finnish law firm Waselius. She advises financial institutions, investors and corporates on securitisation and structured finance transactions across a variety of asset classes and industries, including aviation. She also advises clients on cross-border leveraged financing and capital markets transactions and related regulatory matters and has experience in special situations financing and distressed investments.

Jesus Río Cortés

Partner | Apollo

Partner | Apollo

Mr. Río Cortés joined Apollo in 2019 in Credit and is a partner responsible for investing in asset-backed credit for funds managed by Apollo and Athene Asset Management. Prior to that time, Mr. Río Cortés was an MD in the Securitised Products Group at Bank of America Merrill Lynch from August 2011 to September 2019. Prior to that, Mr. Río Cortés was an MD in the Capital Markets Solutions Group at Société Générale CIB from April 2010 to August 2011, and an MD in the Structured Finance Group at Bear Stearns / JPMorgan from September 2004 to April 2010. Between June 1995 and September 2004, Mr Río Cortes worked also for McKinsey & Company, Goldman Sachs and C.A. Indosuez.

Mr. Río Cortés graduated from ESADE (Barcelona, Spain) with a Licenciado degree in Finance and Economics, and from UNED (Madrid, Spain) with a Licenciado degree in Law, and received his M. Sc. in Management from the Massachusetts Institute of Technology / Sloan School.

Nimesh Verma

Managing Director, Head of Credit Risk Sharing Origination | MAN Group

Managing Director, Head of Credit Risk Sharing Origination | MAN Group

Nimesh is an accomplished banking specialist with a wealth of experience advising banks at a senior level in investment banking advisory and strategy consulting roles. His investment banking role has focused on banking client relationship development and business origination through providing advice around strategic balance sheet management issues. This involved advising on bank regulatory developments, including Basel IV, risk management and risk transfer actions, capital efficiency, funding and liquidity strategies, solvency creation structures, credit ratings, and value management.

Nimesh joined MAN Group in the summer of 2024 after spending 17 years as Director, Bank Advisory at BNP Paribas.

Maria Lehtimäki

Partner | Waselius

Partner | Waselius

Maria is the head of structured finance and securitisation at the independent Finnish law firm Waselius. She advises financial institutions, investors and corporates on securitisation and structured finance transactions across a variety of asset classes and industries, including aviation. She also advises clients on cross-border leveraged financing and capital markets transactions and related regulatory matters and has experience in special situations financing and distressed investments.

Markus Nilssen

Moderator

Partner | BAHR

Partner | BAHR

Henrik Ossborn

Partner | Vinge

Partner | Vinge

Henrik Ossborn is a partner in the banking and finance group at Vinge. He advises on a broad range of finance transactions, with a particular focus on securitisations, supply chain financings, project finance and other asset-based financings. He is a leading practitioner in this field with extensive experience, having worked on these types of transactions for more than 20 years. Henrik has acted for banks, investors and originators across Europe.